I am often asked how we add value to our clients when it comes to their investments. I say the most important job I have is to stop a clients’ behavioral bias from getting the best of them.

Recency Bias convinces us that whatever the market has been doing of late will continue. This is one of the reasons that many investors continue to buy high and sell low when they should be doing the opposite!

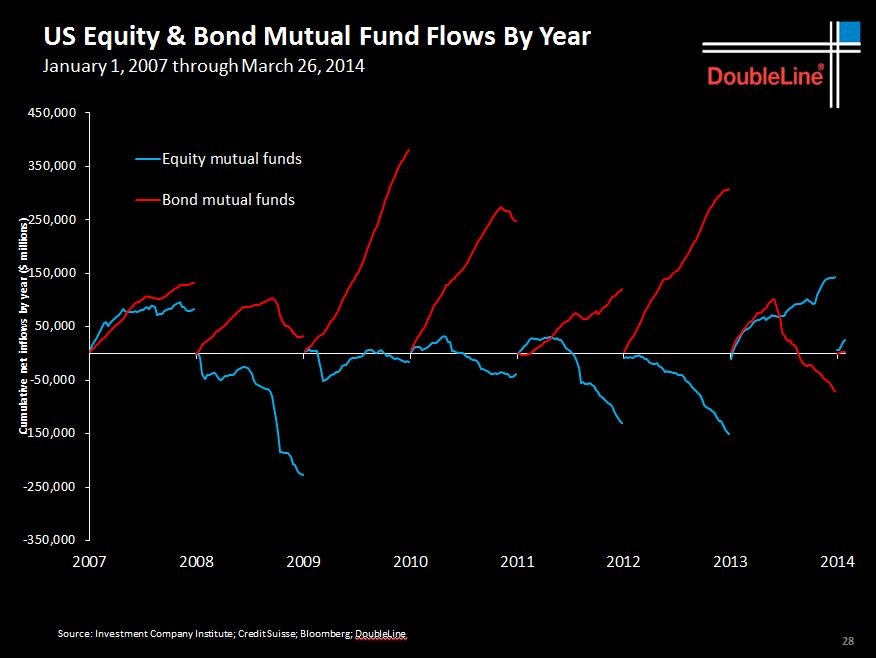

As you can see from the Chart above even after the equity markets rose dramatically in 2009 and 2010 most investors could not get over the fear they experienced from the financial crisis and continued to put money into bond funds and take money out of equity funds.

That trend finally reversed with the dramatic rise in the markets in 2013. Recency bias kicked in and money is following the high equity returns.

Protecting our clients from these biases is one of the most important things we can do.